As investors prepare for 2025, a key decision lies in choosing between Exchange-Traded Funds (ETFs) and index funds for their investment portfolios. Both options offer diversified exposure to various asset classes and sectors, but they differ significantly in structure, costs, and trading flexibility. Understanding the nuances of ETFs and index funds is crucial for making informed investment decisions.

This article will compare these two popular investment vehicles, examining their advantages, disadvantages, and suitability for different investor profiles, to help determine which is better suited for an individual’s 2025 investment strategy.

ETFs vs. Index Funds: A Comprehensive Comparison for Your 2025 Investment Strategy

When it comes to investing for 2025, two popular options that often come up are ETFs (Exchange-Traded Funds) and Index Funds.

Both investment vehicles offer a way to diversify your portfolio by tracking a specific market index, such as the S&P 500. However, they have distinct characteristics that can make one more suitable for your investment strategy than the other.

Understanding ETFs

ETFs are traded on an exchange like stocks, allowing for flexibility in buying and selling throughout the day. This feature is particularly beneficial for investors who wish to capitalize on market fluctuations or need to liquidate their holdings quickly. ETFs also offer a wide range of investment options, including various asset classes and sectors, making them a versatile choice for diversifying a portfolio.

Understanding Index Funds

Index Funds, on the other hand, are a type of mutual fund that is designed to replicate the performance of a specific index. They are typically bought and sold at the end of the trading day, based on the net asset value (NAV) of the fund. Index Funds are known for their low expense ratios and are often preferred by long-term investors who are looking for a straightforward, cost-effective way to invest in the market.

Key Differences and Considerations

One of the primary differences between ETFs and Index Funds lies in their trading flexibility and cost structures. While ETFs offer the ability to trade throughout the day, they may come with higher fees compared to Index Funds, especially for frequent traders. Index Funds, however, may have minimum investment requirements and may not be as tax-efficient as ETFs in certain situations.

| Feature | ETFs | Index Funds |

|---|---|---|

| Trading Flexibility | Can be traded throughout the day | Traded at the end of the day based on NAV |

| Expense Ratios | Varies, can be higher for some ETFs | Generally low expense ratios |

| Minimum Investment | No minimum investment | May have minimum investment requirements |

| Tax Efficiency | Generally more tax-efficient | May be less tax-efficient |

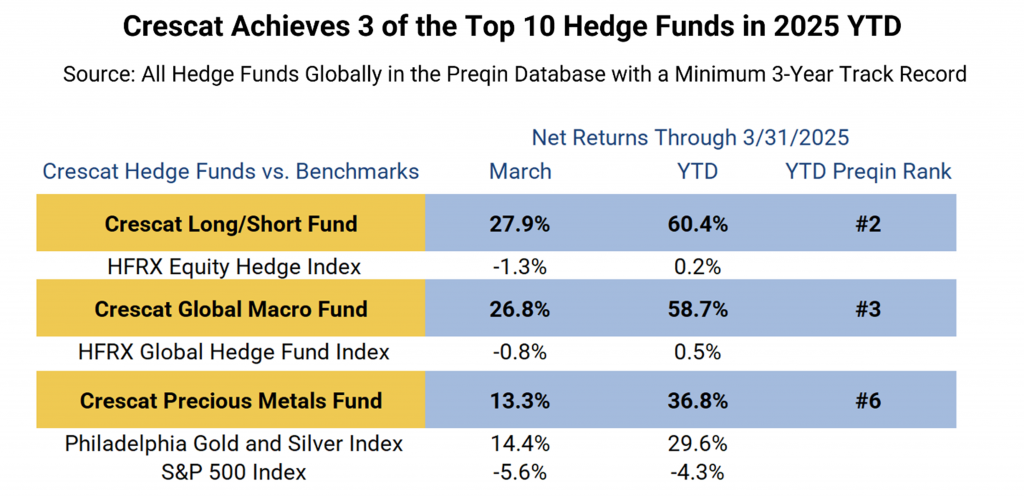

Which funds will perform best in 2025?

The performance of funds in 2025 is difficult to predict with certainty as it depends on various factors such as market conditions, economic trends, and the investment strategies employed by the fund managers. However, based on current trends and expert opinions, some funds are likely to perform better than others.

Factors Influencing Fund Performance

Several factors will influence the performance of funds in 2025, including the overall state of the global economy, interest rates, and geopolitical events. Funds that are able to adapt to changing market conditions and capitalize on emerging trends are likely to perform well.

This content may interest you! The Best Auto Insurance Plans in the U.S. to Save Big in 2025

The Best Auto Insurance Plans in the U.S. to Save Big in 2025- Economic growth and stability

- Interest rate fluctuations

- Technological advancements

Top Performing Fund Categories

Some fund categories are expected to outperform others in 2025, based on current market trends and expert analysis. These include funds that invest in emerging technologies, sustainable energy, and healthcare.

- Technology-focused funds

- Sustainable and environmental funds

- Healthcare and biotechnology funds

Key Investment Strategies

Fund managers who employ effective investment strategies are likely to achieve better returns in 2025. These strategies include diversification, active management, and a focus on long-term growth.

- Diversification across asset classes

- Active management and risk mitigation

- Long-term investment horizon

What to expect from ETFs in 2025?

The Exchange-Traded Fund (ETF) market is expected to continue its growth trajectory in 2025, driven by increasing demand for diversified investment portfolios and the ongoing shift towards passive investing. As the ETF industry evolves, investors can anticipate new product launches, increased competition among providers, and further enhancements to existing funds.

Growth of ESG ETFs

Environmental, Social, and Governance (ESG) ETFs are likely to remain a key growth area in 2025, as investors increasingly prioritize sustainable and responsible investing. ESG ETFs offer a diversified portfolio of companies that meet specific environmental, social, and governance criteria, allowing investors to align their investments with their values.

Some key aspects of ESG ETFs include:

- Improved transparency and disclosure, enabling investors to make informed decisions about their investments.

- Increased product offerings, with new ESG ETFs launching across various asset classes and sectors.

- Growing demand from institutional investors, who are under increasing pressure to demonstrate their commitment to ESG principles.

Advancements in ETF Technology

The ETF industry is expected to benefit from ongoing technological advancements in 2025, with improvements in trading platforms, data analytics, and risk management tools. These advancements will enable ETF providers to offer more sophisticated and targeted investment products, while also enhancing the overall investor experience.

Some key technological developments to watch include:

- The increasing use of artificial intelligence and machine learning to improve ETF portfolio management and optimization.

- The growth of online platforms and digital tools, making it easier for investors to research, compare, and invest in ETFs.

- Advances in data analytics, enabling investors to gain deeper insights into ETF performance and risk characteristics.

Expansion into New Asset Classes

In 2025, ETF providers are likely to continue their efforts to expand into new and emerging asset classes, such as cryptocurrencies and private equity. This expansion will provide investors with greater access to a broader range of investment opportunities, while also increasing the overall diversity of the ETF market.

Some key areas to watch include:

- The launch of cryptocurrency ETFs, which will offer investors a more regulated and accessible way to invest in digital assets.

- The growth of alternative ETFs, which will provide investors with exposure to non-traditional asset classes, such as private equity and hedge funds.

- The increasing use of ETFs as a wrapper for complex investment strategies, such as factor-based investing and smart beta.

What does Warren Buffett say about ETFs?

Warren Buffett has expressed his views on ETFs, stating that they are not the best investment option for most people. According to Buffett, ETFs are often used for speculation and can be detrimental to long-term investment goals.

Buffett’s Criticism of ETFs

Warren Buffett has criticized ETFs for being overly diversified and lacking focus on high-quality investments. He believes that investors should concentrate their portfolios on a few high-conviction investments rather than spreading themselves too thin.

- ETFs can lead to mediocre returns due to their diversification

- Investors may end up owning a small piece of a large number of mediocre investments

- This can result in a lack of significant returns over the long term

Buffett’s Preferred Investment Strategy

Buffett’s preferred investment strategy is to focus on a concentrated portfolio of high-quality investments. He believes in investing in companies with strong fundamentals, competitive advantages, and talented management teams.

This content may interest you! Top 5 Credit Cards for People with No Credit History in the U.S.

Top 5 Credit Cards for People with No Credit History in the U.S.- Buffett looks for companies with a proven track record of success

- He invests in businesses that have a strong potential for long-term growth

- This approach allows him to generate significant returns over time

Implications for Investors

For investors, Buffett’s views on ETFs suggest that they should be cautious when using these investment vehicles. While ETFs can provide broad diversification and flexibility, they may not be the best option for achieving long-term investment goals.

- Investors should carefully consider their investment objectives before investing in ETFs

- They should be aware of the potential risks and limitations of ETFs

- A concentrated portfolio of high-quality investments may be a more effective way to achieve long-term success

Which ETF is best for next 10 years?

The best ETF for the next 10 years is a matter of much debate and depends on various factors such as investment goals, risk tolerance, and market conditions. Historically, some of the top-performing ETFs have been those that track the S&P 500 index, technology stocks, or emerging markets.

Factors to Consider

When evaluating the best ETF for the next 10 years, several factors come into play. These include the underlying assets, fees, trading volume, and the overall economic landscape. Investors should consider their investment horizon, risk appetite, and diversification needs.

- The ETF’s underlying assets and their historical performance

- The expense ratio and other costs associated with the ETF

- The ETF’s trading volume and liquidity

Top-Performing ETF Categories

Some of the top-performing ETF categories over the long term have included technology, healthcare, and finance. These sectors have been driven by innovation, demographic trends, and economic growth. Investors looking for exposure to these areas may consider ETFs that track specific indices or sectors.

- Technology ETFs, which provide exposure to companies like Apple, Microsoft, and Alphabet

- Healthcare ETFs, which include pharmaceutical companies, biotech firms, and healthcare providers

- Financial ETFs, which encompass banks, insurance companies, and other financial institutions

Long-Term Investment Strategies

For investors with a 10-year horizon, a long-term investment strategy is crucial. This may involve dollar-cost averaging, diversification, and a buy-and-hold approach. ETFs can be an attractive option for long-term investors due to their flexibility, transparency, and cost-effectiveness.

- Dollar-cost averaging to reduce the impact of market volatility

- Diversification across asset classes, sectors, and geographies

- A buy-and-hold approach to minimize trading costs and maximize returns

Frequently Asked Questions

What are the key differences between ETFs and Index Funds?

ETFs and Index Funds both track a specific market index, but they differ in their structure and trading flexibility. ETFs are traded on an exchange like stocks, allowing for intraday buying and selling, while Index Funds are traded at the net asset value at the end of the trading day. This difference affects their liquidity, trading costs, and tax implications.

How do the fees associated with ETFs compare to those of Index Funds?

ETFs and Index Funds generally have low fees compared to actively managed funds. ETFs often have lower expense ratios, but may incur trading commissions. Index Funds typically do not have trading commissions but may have higher expense ratios. The total cost depends on the specific fund, trading frequency, and investment amount, making it essential to compare costs for your investment strategy.

Can I use ETFs and Index Funds together in my 2025 investment strategy?

Yes, you can combine ETFs and Index Funds in your investment portfolio. This diversification can help you capitalize on the strengths of each investment type. For instance, you might use ETFs for asset classes that are more liquid or for sectors that you want to actively trade, while using Index Funds for long-term, buy-and-hold investments in core asset classes.

Which is more tax-efficient: ETFs or Index Funds?

ETFs are generally considered more tax-efficient due to their pass-through tax structure and the ability to manage capital gains distributions. ETFs typically do not have to sell securities to meet investor redemptions, reducing the likelihood of capital gains distributions. In contrast, Index Funds may distribute capital gains to shareholders when they sell securities, potentially triggering tax liabilities.

This content may interest you! How to Sell Your House Fast in the U.S. Without Paying High Commissions

How to Sell Your House Fast in the U.S. Without Paying High Commissions