Filing U.S. taxes can be a daunting task, but with the right guidance, individuals can complete the process from the comfort of their own homes without incurring the expense of hiring a professional accountant.

The U.S. tax system is complex, with numerous forms and regulations to navigate. However, by understanding the necessary steps and utilizing available resources, taxpayers can successfully file their returns. This article will outline the process, providing a step-by-step guide on how to file U.S. taxes from home, ensuring accuracy and compliance with tax laws.

Preparing Your Documents and Information for Tax Filing

To file your U.S. taxes from home without hiring an accountant, it’s essential to start by gathering all necessary documents and information. This includes forms such as the W-2 from your employer, 1099 forms for any freelance or contract work, and receipts for any deductions you’re eligible to claim.

Having all your documents in order will simplify the tax filing process and help ensure accuracy.

Gathering Income Documents

Gathering income documents is a critical step in the tax filing process. You’ll need to collect all forms that report your income, including W-2 forms from your employer(s) and 1099 forms for any additional income, such as freelance work or investments. Ensure you have all relevant forms, as these will be used to report your total income to the IRS.

Identifying Deductions and Credits

Identifying deductions and credits is a crucial part of minimizing your tax liability. Standard deductions and itemized deductions are two primary options for reducing your taxable income. Itemized deductions can include expenses such as medical expenses, mortgage interest, and charitable donations. You should also explore available tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, which can directly reduce the amount of tax you owe.

Choosing a Filing Status and Reporting Dependents

Your filing status and the number of dependents you claim can significantly affect your tax obligations. The IRS recognizes several filing statuses, including Single, Married Filing Jointly, and Head of Household. Accurately reporting your filing status and dependents is crucial, as it impacts your tax rates and eligibility for certain deductions and credits.

| Document/Form | Purpose | Required Information |

|---|---|---|

| W-2 Form | Reports income from employment | Employee’s name, address, Social Security number, income earned, taxes withheld |

| 1099 Form | Reports income from freelance or contract work | Payer’s name and address, recipient’s name and address, Social Security number or EIN, income earned |

| Receipts for Deductions | Supports claims for deductions | Date, amount, description of expense, and any relevant details (e.g., business use percentage for home office deduction) |

Can I file my tax return by myself?

You can file your tax return by yourself, but it requires a good understanding of tax laws and regulations. The process involves gathering all necessary documents, including W-2 forms, 1099 forms, and receipts for deductions, and then accurately reporting this information on the tax return. The IRS offers various resources to help individuals file their tax returns, including free filing options for those who meet certain income thresholds.

Benefits of Filing Your Tax Return Yourself

Filing your tax return yourself can provide several benefits, including cost savings and greater control over the filing process. By handling the filing yourself, you avoid paying fees to a tax professional. Additionally, you have the flexibility to file at your own pace and can make changes as needed.

This content may interest you! Top Free Accounting Apps for Freelancers and Small Businesses in the U.S.

Top Free Accounting Apps for Freelancers and Small Businesses in the U.S.- You save money on tax preparation fees.

- You have more control over the filing process and can ensure accuracy.

- You can file at your convenience, without having to schedule an appointment.

Challenges of Filing Your Tax Return Yourself

While filing your tax return yourself can be beneficial, it also presents several challenges. Tax laws and regulations are complex and subject to change, making it difficult for individuals to stay up-to-date. Furthermore, the process requires a significant amount of time and effort to gather necessary documents and accurately complete the tax return.

- You need to stay current with changing tax laws and regulations.

- The process can be time-consuming, especially if you have complex tax situations.

- You may miss out on deductions or credits if you are not aware of them.

Resources Available for Self-Filing

Fortunately, there are several resources available to help individuals file their tax returns themselves. The IRS offers free filing options, including IRS Free File, which provides free tax preparation and filing for individuals who meet certain income thresholds. Additionally, many tax software companies offer free or low-cost filing options for simple tax returns.

- IRS Free File provides free tax preparation and filing for eligible individuals.

- Tax software companies offer free or low-cost filing options for simple tax returns.

- The IRS website provides access to tax forms, instructions, and other resources.

Is direct file IRS good?

The IRS Direct File program is a free service that allows eligible taxpayers to file their tax returns directly with the IRS, without the need for third-party tax preparation software or professionals. This program is designed to simplify the tax filing process and reduce the burden on taxpayers.

Benefits of Using IRS Direct File

The IRS Direct File program offers several benefits to taxpayers, including reduced costs and increased convenience. By filing directly with the IRS, taxpayers can avoid the fees associated with commercial tax preparation software and professional tax preparation services. Additionally, the program is designed to be user-friendly and easy to navigate, making it accessible to a wide range of taxpayers.

- Reduced costs: Taxpayers can avoid fees associated with commercial tax preparation software and professional tax preparation services.

- Increased convenience: The program is designed to be user-friendly and easy to navigate.

- Improved accuracy: The IRS Direct File program is designed to reduce errors and improve accuracy.

Eligibility and Limitations

To be eligible for the IRS Direct File program, taxpayers must meet certain requirements, such as having a simple tax return and meeting certain income thresholds. The program is currently limited to certain states and types of tax returns, but the IRS plans to expand the program in the future. Taxpayers should check the IRS website to determine if they are eligible to use the program.

- Simple tax returns: Taxpayers with complex tax returns may not be eligible for the program.

- Income thresholds: Taxpayers with incomes above certain thresholds may not be eligible.

- State limitations: The program is currently limited to certain states.

Security and Support

The IRS Direct File program is designed to be secure and provide support to taxpayers. The program uses advanced security measures to protect taxpayer data and ensure that tax returns are filed accurately and securely. Taxpayers can also access support resources, such as online help and customer support, if they have questions or need assistance with the program.

- Advanced security measures: The program uses encryption and other security measures to protect taxpayer data.

- Online help: Taxpayers can access online help resources, such as FAQs and user guides.

- Customer support: Taxpayers can contact customer support if they have questions or need assistance.

Can you legally do your own taxes?

In many countries, individuals are allowed to prepare and file their own tax returns, provided they comply with the relevant tax laws and regulations. The complexity of tax laws can vary significantly, and individuals must ensure they accurately report their income, claim legitimate deductions, and adhere to filing deadlines to avoid penalties.

Eligibility to File Your Own Taxes

To determine if you can legally do your own taxes, you need to assess your financial situation and the complexity of your tax return. Generally, individuals with straightforward financial situations, such as those with a single source of income and few deductions, can manage their own tax filings.

This content may interest you! How Much Does Plastic Surgery Really Cost in the U.S. in 2025?

How Much Does Plastic Surgery Really Cost in the U.S. in 2025?- Having a simple income structure, such as a single job or a straightforward self-employment situation.

- Familiarity with tax laws and regulations applicable to your situation.

- Being organized with all necessary tax documents, including receipts for deductions and records of income.

Benefits of Preparing Your Own Taxes

Preparing your own taxes can offer several benefits, including cost savings on professional tax preparation fees and a deeper understanding of your financial situation and tax obligations. By taking an active role in tax preparation, individuals can also ensure accuracy and maintain control over their financial data.

- Cost savings from not hiring a professional tax preparer.

- Enhanced understanding of personal tax obligations and financial situation.

- The ability to file tax returns promptly, potentially speeding up the refund process if applicable.

Potential Risks and Considerations

While doing your own taxes can be beneficial, there are risks involved, particularly if you have a complex financial situation or are unfamiliar with tax laws. Errors or omissions can lead to audits, penalties, or missed opportunities for tax savings. It’s essential to weigh these risks against the benefits.

- The risk of making errors or omitting crucial information.

- Missing out on deductions or credits due to lack of knowledge.

- Potential for audits or penalties if tax laws are not followed correctly.

Should I file my own taxes or hire an accountant?

Deciding whether to file your own taxes or hire an accountant depends on several factors, including the complexity of your tax situation, your comfort level with tax preparation, and the potential costs involved. Filing your own taxes can be a cost-effective option, but it requires a significant amount of time and effort to ensure accuracy and compliance with tax laws.

Benefits of Filing Your Own Taxes

Filing your own taxes can be beneficial if you have a simple tax situation, such as a single income source and no dependents. You can use tax preparation software to guide you through the process and help you identify potential deductions. Some benefits of filing your own taxes include:

- Saving money on accountant fees, which can range from $100 to $500 or more, depending on the complexity of your tax situation

- Having control over the tax preparation process and being able to make changes as needed

- Being able to file your taxes at your own pace and on your own schedule

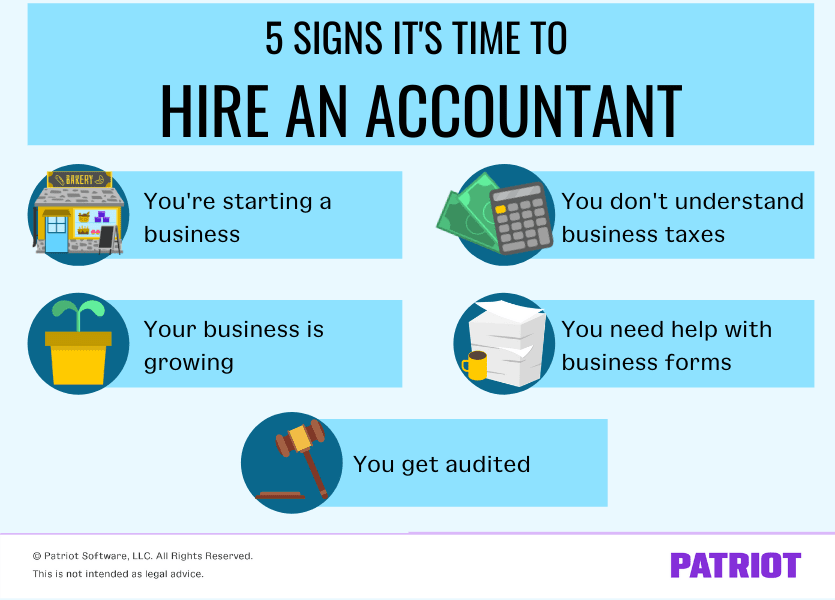

Benefits of Hiring an Accountant

Hiring an accountant can be beneficial if you have a complex tax situation, such as multiple income sources, investments, or self-employment income. An accountant can provide expert guidance and help you navigate complex tax laws and regulations. Some benefits of hiring an accountant include:

- Ensuring accuracy and compliance with tax laws, which can help you avoid costly penalties and fines

- Identifying potential tax savings opportunities, such as deductions and credits that you may not be aware of

- Providing representation in case of an audit or other tax-related issues

Factors to Consider When Deciding

When deciding whether to file your own taxes or hire an accountant, there are several factors to consider. These include the complexity of your tax situation, your level of comfort with tax preparation, and the potential costs involved. You should also consider:

- The potential risks and consequences of errors or omissions on your tax return

- The value of your time and the opportunity cost of spending time on tax preparation

- The level of support and guidance you need to ensure accuracy and compliance with tax laws

Frequently Asked Questions

What are the basic requirements for filing U.S. taxes from home?

To file U.S. taxes from home, you will need to gather necessary documents, including your Social Security number, W-2 forms, 1099 forms for any freelance work, and receipts for deductions. You will also need to choose a filing status and decide whether to itemize deductions or take the standard deduction. Additionally, you will need to have a computer and internet access to e-file your taxes.

What forms do I need to file my U.S. taxes?

The forms you need to file your U.S. taxes depend on your individual situation. Most taxpayers will need to complete Form 1040, which is the standard form for personal income tax returns. You may also need to complete additional forms, such as Schedule A for itemized deductions or Schedule C for self-employment income. You can download the necessary forms from the IRS website or use tax preparation software to guide you through the process.

How do I e-file my U.S. taxes from home?

To e-file your U.S. taxes from home, you can use tax preparation software, such as TurboTax or H&R Block, which will guide you through the tax preparation process and submit your return electronically to the IRS. You can also use the IRS Free File program if you meet certain income requirements. Make sure to have all necessary documents and information ready before starting the e-filing process.

This content may interest you! 7 Profitable Side Hustles You Can Start from Home in the U.S.

7 Profitable Side Hustles You Can Start from Home in the U.S.What are the benefits of e-filing my U.S. taxes?

E-filing your U.S. taxes offers several benefits, including faster refunds, reduced errors, and increased security. E-filed returns are typically processed within a few days, and refunds are issued quickly via direct deposit. Additionally, e-filing reduces the risk of errors, as tax preparation software checks for mistakes and inconsistencies. E-filing also provides a secure and encrypted way to submit your tax return to the IRS.